Powerful, Seamless Digital Payments

DigitalPay offers cost-effective, instant payouts to hundreds of endpoints. Managed via a secure, web-based SaaS platform, our solution delivers payments with unparalleled choice, ease, and speed to desktop or mobile devices.

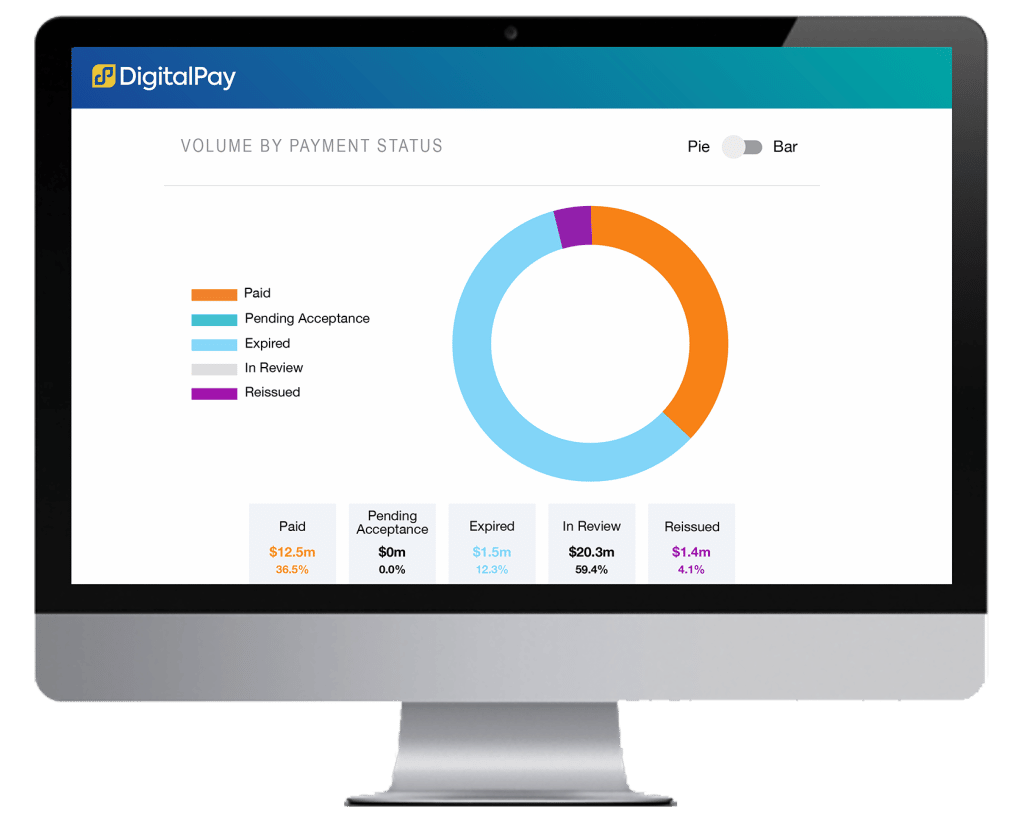

Payouts made through DigitalPay are fully traceable and easily integrated into systems of record for settlement and reconciliation—every transaction, every time.

Platform Components

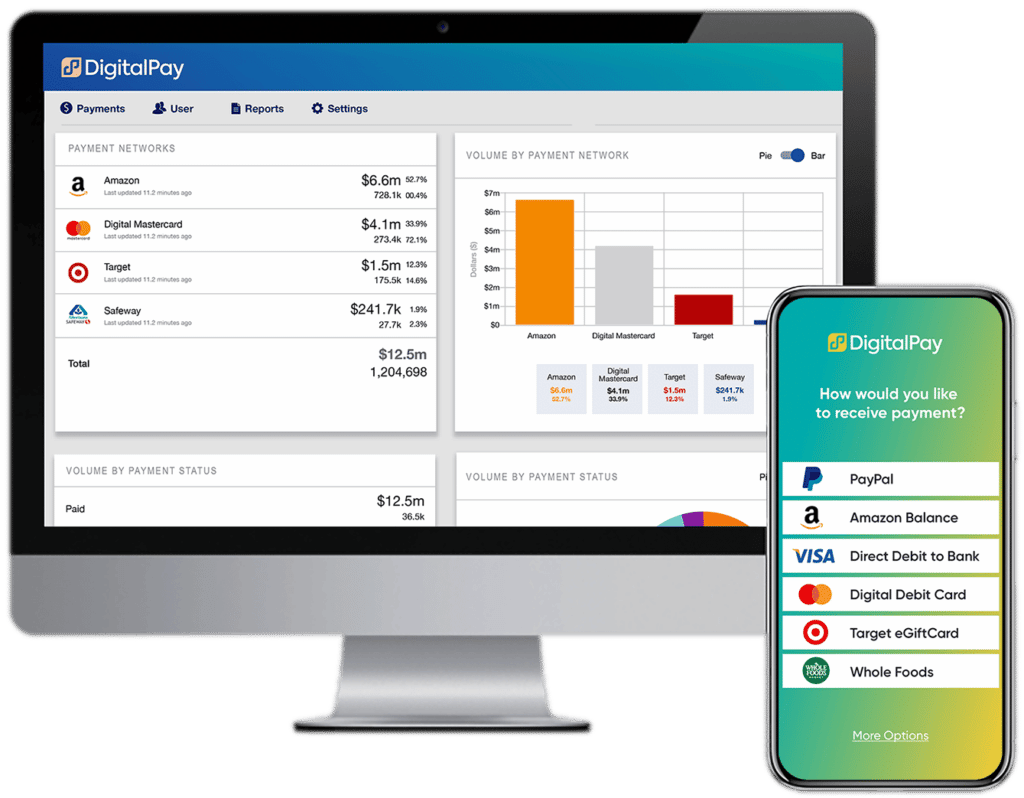

Payee Experience: The Paywall

A web-based experience that requires no app downloads or onboarding. The paywall is customized to your brand and desired payment options while keeping your payee updated on the status of their funds from selection to completion.

User Portal

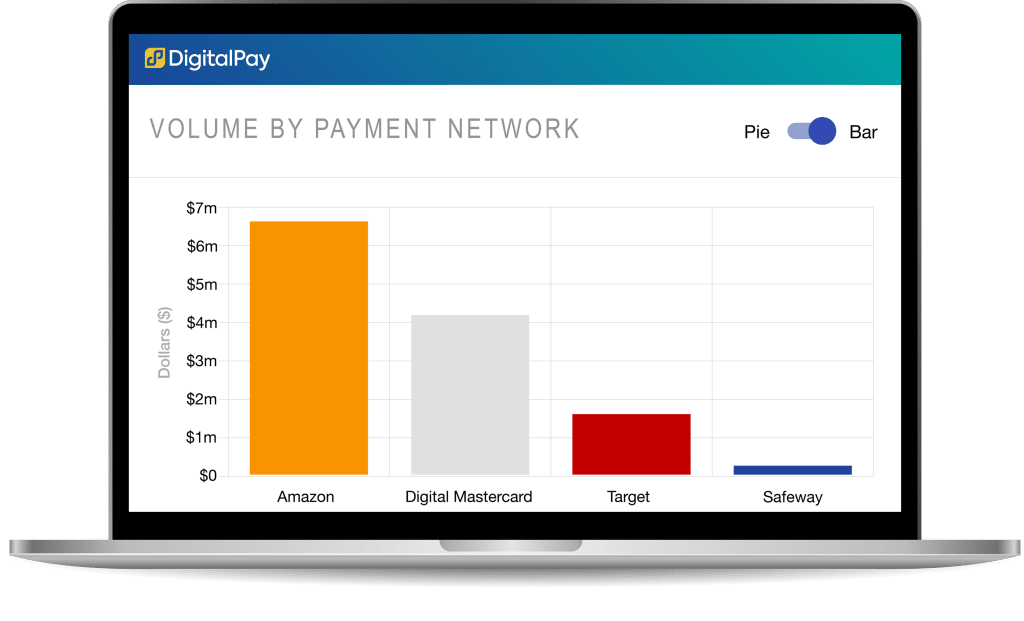

A rich administrative portal with enterprise-grade features, configurable workflows, and permission management to control, approve, and send payments—individually or by millions. Full analytics and reporting according to your financial and A/P needs.

Funding and Payment

Handled via a centralized settlement account with customized management, workflow and controls.

The DigitalPay Platform has flexible APIs for easy integration into core systems of record for centralized settlement and reconciliation. In most situations, no internal IT support is needed for deployment.

Enterprise-class Capabilities:

See DigitalPay in Action

Fast, Easy Deployment

SaaS Platform + APIs

A secure, nimble SaaS platform with APIs ensures quick deployment with light IT support. Plus, a highly configurable interface means business users can easily make system changes.

ERP Integration

DigitalPay APIs enable direct connection to your accounting and payment systems, call center applications, and other systems of record for easy, centralized reconciliation.

Customizable Workflows

Built with the highest levels of flexibility, the DigitalPay platform can be easily custom-configured to your business and payment needs across a multitude of use cases.